While the global economy might be showing some worrying signs, hospitality investors are still cautiously optimistic about the sector, although actually putting money into it is proving more difficult, according to the latest Hospitality Insights Investor Sentiment Index.

Revenue vs profitability

Despite economists predicting a slowdown across major economies, 80% of the investor audience envisage demand from the leisure segment to continue to grow or for the pace of growth to accelerate over the next 12 months. That’s probably what is underpinning their conviction in the sector, although it is worth pointing out that events are moving quite quickly. GfK’s long-running Consumer Confidence Index, for example, hit a new record low of -44 in August.

Belief in the sector’s fundamentals even in a tough economy, also shows up in questions about revenue. So far this year daily room rates have been able to rise to keep up with inflation and investor confidence in total revenue growth remains strong over the next 12 months, with 26% of investors polled anticipating a continued increase in revenue at current growth levels, and 61% expecting an acceleration in growth.

But this doesn’t tell the full story. Crucially, investors do not feel the same way about profitability. 44% expect a decline in the next 12 months as rising costs chip away at profit. Labour costs are increasing as are energy bills with predictions that they could skyrocket this winter.

“Coming from a low base, it is not unsurprising that hospitality investors are confident about growth in total revenue in the next 12 months. However, profit is under pressure, in the UK for example, soaring inflation is hitting cost of sales and the industry is in the midst of a staffing crisis,” said Michael Grove, chief operating officer, at HotStats.

Changing tastes

One of the knock-on effects of rising costs is the type of hotels that investors are interested in. Limited service properties are becoming much more attractive because they are less reliant on people, less exposed to the absent MICE segment as well as rising food and beverage costs and in-room amenities.

At the same time buzz around resort properties has started to die down with urban hotels indexing slightly higher, reflecting the more positive response from investors to the prospect of growth in demand in the corporate segment versus the leisure segment.

Core and Core+ investors are moving out of resort space and into the urban, which could potentially be a defensive play. These investors favour low-risk income-generating investments with a more diversified demand profile. These assets also have the safety net of alternative use potential and strong residual land values.

Tough to buy

The “wall of money” that was so often talked about in investment circles is still there. According to our survey, 93% stating that their unallocated capital was now the same or higher than the previous quarter, highlighting an imbalance between supply and demand.

Even though there is plenty of money available, deals are reportedly taking longer to complete with 50% of our investor audience also stating that the competition to acquire hospitality investment opportunities has increased.

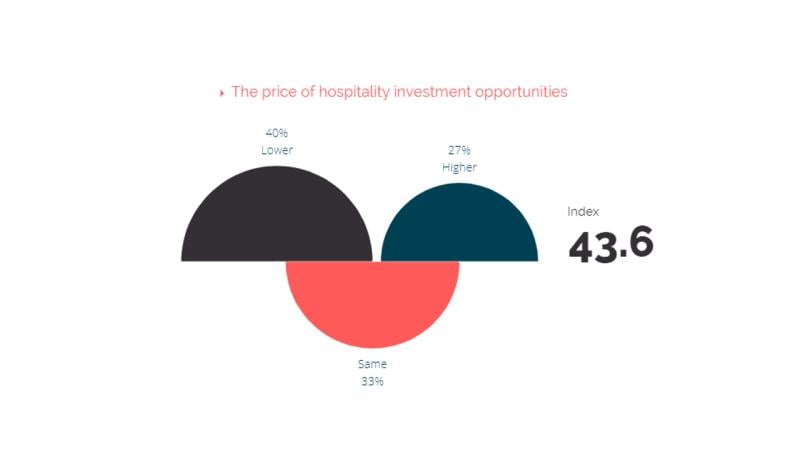

Investors are, however, split on the trajectory of valuations. 27% expecting a rise in prices and 40% expecting a decline. The difference of opinion is going to make it tough for advisors over the coming months when it comes to working out what a fair offer is.