This is the first article in what will be a regular series looking at a snapshot of deals over the course of a quarter.

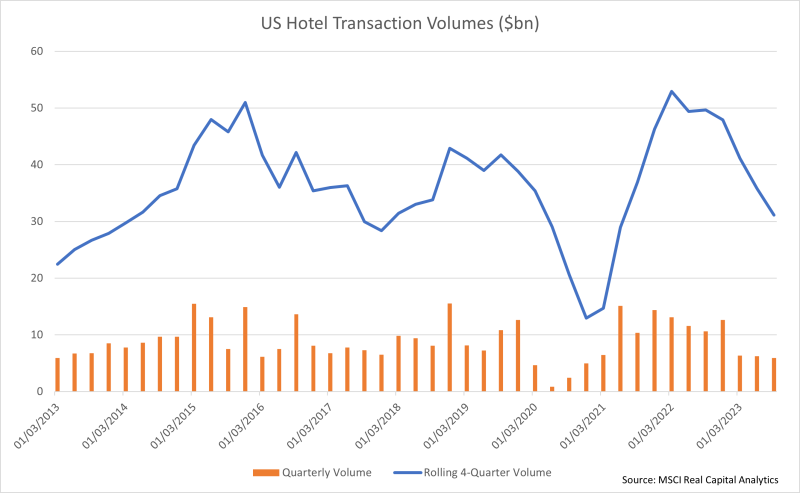

Overall transaction volumes have remained pretty subdued all year, with the third quarter coming in at $5.94 billion, according to data from MSCI Real capital Analytics. This was almost half as much as the same period in 2022, which totalled $10.61 billion.

Unsurprisingly the New York City metro area was out in front at $1.5 billion in Q3 followed by Phoenix ($465 million) and Dallas (236 million).

July

Outrigger Kā‘Anapali Beach Hotel

Location: Maui, Hawaii

Buyer: Outrigger Enterprises

Seller: Kaanapali Properties Corp

Price: $121m (estimate)

Size: 432 units

HI Take: Outrigger will have leapt at the opportunity to add another hotel in its home market of Hawaii. The company, which was bought by KSL in 2016, has established itself as one of the premier high-end leisure brands in the markets of Hawaii, Fiji, Mauritius, Thailand and the Maldives. The hotel was refinanced back in April 2021.

DoubleTree Resort by Hilton Paradise Valley

Location: Phoenix, Arizona

Buyer: GHIG

Seller: SW Value Partners

Price: $115.5m

Size: 378 units

HI Take: The property has now changed hands three times in the last five years, almost doubling in value over that period. GHIG founder and CEO Kevin Colket, said the deal exemplified the firm's strategy of "of acquiring high-quality, irreplaceable assets in markets with strong demographic tailwinds and favourable supply and demand dynamics".

The Inn at Rancho Santa Fe

Location: San Diego, California

Buyer: GEM Realty Capital

Seller: Long Term Assets (Steve Hermann)

Price: $100m

Size: 87 units

HI Take: The transaction history of this property shows just how much investors are willing to pay for differentiated offerings. In May 2022 it sold for $42.3 million. Just over a year later the price had more than doubled. Steve Hermann Hotels had already started on an extensive renovation and Elliot Eichner, principal at Sonnenblick-Eichner, who represented the seller, said "The buyer recognized an incredible opportunity to acquire a five-star luxury resort in a market with extremely high barriers to entry".

August

Park Lane Hotel

Location: Manhattan, New York

Buyer: Qatar Investment Authority

Seller: Witkoff Group and others

Price: $623 million

Size: 631 units

HI Take: Few hotels have as much of a storied history as the Park lane Hotel. The property was once owned by Leona Helmsley, who bequeathed millions to her dog, and was also tied up in the 1MDB scandal. None of that has put of the Qataris who have been happy to shell out million on what was once dubbed the “world’s greatest site for development”. It just goes to show that location and prestige are probably the biggest moats in real estate investing.

Gramercy Park Hotel

Location: Manhattan, New York

Buyer: MCR

Seller: Solil Management Group

Price: $179.8m (estimate) / $50m press reports

Size: 186 units

HI Take: Another hotel with a troubled recent past. The property shut its doors at the beginning of the Covid-19 outbreak and never re-opened. In the intervening years it has been best by internal squabbles between stakeholders. Owner/operator RFR Holding was ousted by landowner Solil Management over unpaid rent in June last year. Then Danny Meyer's Union Square Hospitality Group, which ran the ground floor restaurant Maialino, sued Solil in October. “We will return this beloved hotel to its original splendor as the jewel of Gramercy Park — one of the most magical and unique neighborhoods in Manhattan,” said Tyler Morse, CEO of MCR.

BREIT AZ/FL Hotel Portfolio 2023

Location: Various locations in Florida and Arizona

Buyer: Three Wall Capital

Seller: Blackstone/BREIT

Price: $114m

Size: 642 units

HI Take: Three Wall Capital is a longstanding investor in hospitality real estate and this deal adds to its presence in a couple of markets. Blackstone bought the properties itself back in 2019 and appears to have made a profit on each of the hotels it has now sold on.

September

McSam Hotel Group Manhattan portfolio

Location: Manhattan, New York

Buyers: Magna Hospitality Group - Motto by Hilton New York City Times Square and Hampton Inn by Hilton NY Times Square and Home2 Suites - LLC linked to Dauntless Capital Partners (news reports)

Seller: McSam Hotel Group

Price: $450m

Size: Motto by Hilton New York City Times Square (400 units) and Hampton Inn by Hilton NY Times Square and Home2 Suites (574 units in total)

HI Take: Prolific New York City developer Sam Chang announced he was quitting the hotel game to spend more time with his racing pigeons back in 2019. He has spent the past couple of years offloading projects and properties. These latest two deals will help swell his coffers as he heads into retirement.

Hilton Canopy Scottsdale

Location: Scottsdale, Arizona

Buyer: Dynamic City Capital

Seller: Miller Global Props

Price: $101.8m

Size: 177 units

HI Take: This was the second substantial hotel deal in the Phoenix area during the quarter, showing the vibrancy of the market for hotel investors. Last November the Four Seasons Resort Scottsdale at Troon North in north Scottsdale changed hands for $267.8 million.

Intercontinental Houston Med Center

Location: Houston, Texas

Buyer: Stockdale Capital Partners

Seller: MediaStar

Price: $86.5m

Size: 353 units

HI Take: A useful reminder to everyone that it’s not all about leisure. The property is located in the Texas Medical Centre, in what is described as the largest medical complex in the world. The hotel is also close to a sports stadium, a university and the museum district.

Dream Nashville Hotel

Location: Nashville, Tennessee

Buyer: Printers Alley Investments

Seller: Royal Investments

Price: $82.6m

Size: 168 units

HI Take: A really interesting hotel, sandwiched between a number of properties in downtown Nashville. The property opened in 2019 and mixes historic and contemporary architecture. The brand behind the hotel, Dream Hotel Group, was bought by Hyatt earlier this year and included a total of 12 lifestyle hotels.