Deal opportunities are forecast to increase over the next 24 months driven by higher interest rates, Christie & Co’s Hotels 2023 Mid-Year Review has revealed.

The hotel property adviser said that while the UK hotel sector has been able to withstand a challenging trading performance over the first half of 2023 with trading performance expected to maintain its upwards albeit decelerating trajectory, a longer period of high interest rates means many hotels will have to refinance at much higher margins and may have no other option than to sell.

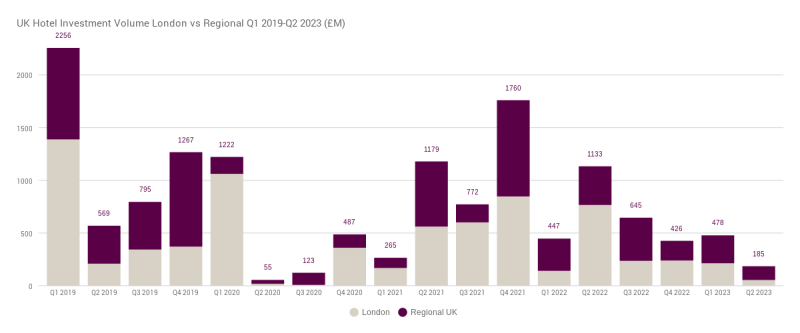

This forecast follows a first half during which transactional volumes were more than halved year-on-year. Individual deals dominated market activity due to the challenges around financing of portfolios. Positively however, there remains no shortage of capital keen to invest in hotels as they have proven a good hedge against inflation, boosted by demand growth.

By region, Christie & Co said Scotland proved to be a standout player, benefiting from offering better value for money than many hot spot areas in England's South. This attracted both large overseas investors seeking yield and small lifestyle purchasers looking for a bang for their buck. The sale of Crerar Hotel Group to Blantyre Capital / Fairtree Hotel Investments is indicative of the appeal of Scotland to private equity.

In the North East and Yorkshire, buyer appetite remains strong, despite limited new opportunities coming to market in the first half. This shortage of stock has resulted in a renewed interest in existing opportunities, especially in leisure-oriented and tourist-led locations like coastal resorts, rural locations, or national parks.

The market in the North West region remained active, with renewed interest from buyers. Demand was high for quality hotels with a significant number of rooms, especially in popular tourist destinations such as Manchester, Liverpool, the Lake District and along the coast.

Demand for good quality hotel opportunities in the Midlands remained strong throughout the first half of 2023, although competitive pricing was key to attracting interest.

The London hotel market witnessed a continuing imbalance of supply and demand in the first half of 2023, though overseas buyers maintained interest, viewing the capital as a safe haven for investment. Trading-wise, London hotels performed well, recording high occupancy levels and an ever-improving room rate, which maintained buyer appetite.

Despite a slight dip in sales volumes compared to 2022, North Wales remained a hotspot for lifestyle buyers and existing operators looking to expand.

What they said

Carine Bonnejean, managing director – hotels at Christie & Co said: “Whilst market activity remained sluggish for most of H1, we started to see some positive signs of a shift in the lead up to summer, suggesting that activity will be stronger during H2. We remain optimistic that we will see increased opportunities throughout the rest of 2023.