The hospitality sector, particularly the hotel industry, has been on a rollercoaster over the past few years, enduring the pinch of the Covid pandemic and enjoying a strong comeback post-pandemic.

But while the hotel sector has benefited from increased tourism and a strong revival of consumer demand, there are myriad other areas of concern, colouring not just the current landscape but also how the sector fares in the coming months and years.

Transaction volumes

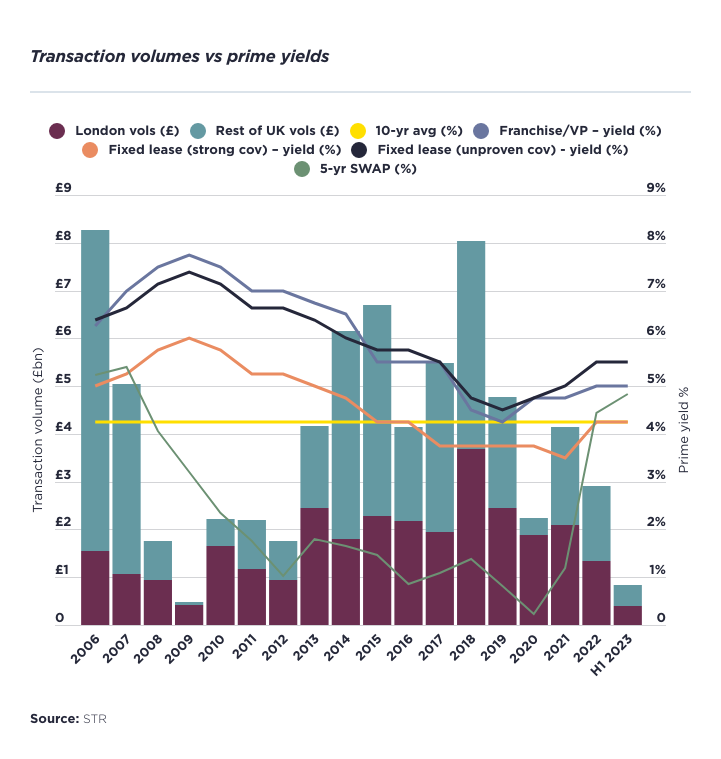

One of these is the volumes of hotel transactions which have slowed considerably, when compared with last year and before the pandemic hit (see the below chart from Savills).

“Average annual deal volumes up until 2019 was about £5.5 billion a year. Transaction volumes grew in 2021, back up to that long-term average. However, off the back of high interest rates in the second half of 2022, we saw declines and 2022 finished at £3 billion,” says Kerr Young, executive vice president, Hotels at JLL.

He notes that transactions which have happened year-to-date are few and smaller, adding that transaction volumes are down year-on-year by about 60 per cent.

This drop in transaction volumes is a result of the difficulty when it comes to getting debt due to high interest rates as well as a lack of stock being brought to the market, experts explain.

Pippa Harrison, head of hotel capital markets at Avison Young notes “We have plenty of clients that have money and capital to deploy but finding the right product has been difficult. There hasn't been a lot of stock brought to the market.”

Julian Troup, head of hotels agency at Colliers adds: “This really is indicative of the fact that there are challenges in the marketplace, with one of them in particular being getting debt. That's the hardest thing.”

Heading into the autumn and through the end of the year, Troup says that while he’s seeing expansion amongst existing UK companies, he doesn’t expect any major changes. “I think there will continue to be activity taking place, but it's just not the kind of level that it was 12 to 24 months ago. In terms of what's going to happen in the next three to six months, I just I don't think anything drastic is going to change. I think there’ll just be a continual flow, a slower flow of deals going through.”

However, Kerr disagrees, saying “We do anticipate an increase in transactional volumes over the course of the next 18 months and there are a number of larger processes – both in terms of large single assets and portfolios – that are anticipated to transact before the end of this year.”

Assets of interest

So what assets are generating the most interest amongst investors?

Troup says its higher-quality assets, noting that while there’s always interest in London, the shortage of high-quality stock in the capital means quality stock in areas like Oxford, Cambridge, the Cotswolds and the Lake District are seeing increased interest.

Kerr notes other assets generating interest are those that can be improved and offer attractive returns to value-add investors, luxury assets and limited service or economy assets.

“Luxury assets that are able to pass on the current inflation to customers and limited service or economy assets that are able to best manage and mitigate costs, are the two asset classes that are of most interest to both investors and consumers. Our views are that most consumers and investors will look for either an experiential opportunity or a value proposition,” he explains.

Harrison agrees that economy assets have become increasingly popular owing to budget hotels performing extremely well with consumers. “For investors looking at the overview of the economy going forwards, obviously the budget market sits comfortably with where both leisure and corporate markets are reviewing their costs. So as they are trading well, I think we’ll continue to see demand for budget hotels.”

She adds that golf and spa hotels are also holding up really well due to the demand of domestic short breaks as a result of the drastic increase in the cost of travelling abroad.

“Room rates for UK golf and spa hotels have been excellent. I think that with the weak pound as well, we've definitely seen an increase with Canada and US visitors in Scotland, the Lakes etc, and it has driven room rates. We're talking to investors who are keen on that type of investment and I expect that to continue,” she says.

Richard Dawes, director - EMEA hotel capital markets at Savills believes assets ripe for branding are the flavour of the season, stating “Hotel assets that are seeing the most movement and generating the most interest amongst buyers are those that someone can come along and put their own flag on it. And that is attracting good interest from both domestic and international owner operators.”

Who’s buying?

In terms of the buyer pool, Troup says a lot of the volume in current transactions are coming from independent entities – existing hotels be it family or groups which are UK-based – as well as a mixture of overseas and domestic hotel companies that are looking to expand.

Dawes adds “Fundamentally, what is keeping hotel investment going is the weight of cash with owner operators who are pushing deals; for example, Dalata and their expansion drive, buying two hotels already in London this year.”

He notes that the predominant buyers right now are European owner-operators - spotlighting Dalata and Fattal - and domestic investors for the sub-£10 million projects.

“For institutions, we’ve seen Pandox being particularly active,” he adds.

Kerr agrees, noting “Where we have seen the strongest interest over the last six to 18 months is from well-capitalised owner operators. A lot of these owner operators have seen very strong trading performance over the course of the last 12 months and are sitting on a war chest of equity to invest and expand their platforms.”

Harrison adds that Avison Young is seeing a lot of interest from overseas buyers angling to take advantage of the weak pound, shining a spotlight on overseas private family trusts, who are now seizing opportunities previously out of their grasp due to the muted activities of investment and pension funds.

For those looking to sell, experts stress the importance of being realistic with pricing so there’s less of a gap between seller and buyer expectations.

Positively, Harrison says she believes this is an opportune time for potential sellers. “Hotels are performing well, stock is low and there’s a lot of interest. We have a weak pound and strong demand from overseas buyers.

“As things start coming through and we see prices, and they are better than people expected - and generally this is because there's not enough stock - then you'll start seeing more product come into the market. And then naturally, the prices will level out. So if I was a vendor thinking of selling then I would be doing it now.”

Distressed sales

Turning to the market’s anticipation of distress, most of the experts say they don’t expect huge amounts of overt distress in the marketplace, with Troup highlighting the keenness of banks to try to support customers as best they can.

“I don't think we're going to see the big double-digit discounts across the whole market. I think there's enough confidence in the sector and there’s enough liquidity through debt finance to support good quality real estate,” Dawes says.

However, Kerr and Dawes note that continued bank support will most-likely just apply for high-performing hotel assets.

“If you have a hotel that hasn't had a fair amount of capital invested in it over the last five years in a poor location, there is going to be a pressure point for that asset because it doesn't tick a lot of the requirement boxes. Banks are going to be less excited about supporting the repositioning of that asset because the location doesn't work or the concept doesn't work,” Dawes says.

Kerr adds: “I think there's undoubtedly going to be an increased amount of consensual sales. Unfortunately, we are going to see an increase in insolvencies and those insolvencies will result in transactions. However, I don't believe that that is going to be the case for best-in-class assets or best-in-class operators predominantly because the underlying fundamentals and the inflation tailwinds are hugely benefiting hospitality above any other asset class at the moment.”

However, Harrison warns she has started to see forced sales coming through, noting that work is ongoing with a number of banks who are actively reviewing the situation.

“I've just exchanged on a hotel that was through the liquidators for a bank, and I’m working with the liquidators on another few opportunities of hotels that are coming their way. I think a lot of these deals will be quiet and we won’t see too may of these deals brought to the open market because the banks will want to be discreet.”

The road ahead

Looking forward, experts are cautiously optimistic and are looking to the road ahead with positivity.

Kerr believes there’ll be an uptick in transactions over the next six to 18 months, noting that there are a number of transactions currently being progressed that are in excess of the £85 million sale of the Waldorf Astoria in Edinburgh and adding he anticipates an increase in transactions in London across the next six months.

“We have a high degree of confidence that we'll see an increase in transaction volumes over the course of the next six months. And we also anticipate an increase across 2024 and that will be from existing investors who are selling because it's the end of the fund life and assets that are being sold because they are at the end of their current financing arrangements and it's a challenging environment to refinance,” he says.

He adds: We anticipate seeing larger single assets and portfolios start to be presented to the market as investors become more confident about the macroeconomic backdrop.”

He says that if transaction volumes finish above £3 billion this year, then it’ll be up on last year. And if that happens, it’s expected that they increase closer to the £5.5 billion long term average next year. However, this is heavily influenced by what happens with interest rates.

Dawes notes that the light at the end of the tunnel in terms of interest rates is giving a bit more confidence to deploy capital, noting that Savills sees “quite a few deals happening over the next quarter.”

“There are some big portfolios that are being worked through and there are a few big standalone assets that are out there or being discussed both on market and off market. So I'm not hugely concerned that we're going to get stuck at around the same level we’re at now for the rest of the year.

There’s enough confidence, positive sentiment and enough inquiries from investors that I think the market will be okay in terms of deal volumes. We're seeing very strong appetite from the Middle East and Asian capital looking to Western Europe,” he says.

However, he warns that if the Bank of England rate doesn’t stabilise over the next few months, it will delay the return to market for some investors and slow the expected increase in volumes.

Troup concurs. “If inflation comes down and interest rates come down, then the level of activity should start to pick up perhaps in the springtime of next year. If however, things don't move forwards, then it will be a different story altogether.

Operational challenges

However, interest rates – while being the biggest concern – is not the only challenge the sector faces, with rising energy costs, payroll inflation, higher labour costs, staffing difficulties and food cost inflation adding pressure.

Dawes says costs seem to be stabilising and not going up heavily in the latter half of this year versus the bigger increases seen last year with utilities and payroll pressures, with Kerr noting that while it seems that energy costs are starting to come into line, the cost structure of any hotel P&L remains exceptionally challenging.

However, Harrison is less optimistic in the regard of costs coming down.

“Hopefully we will see a difference in utilities but I'm not sure it's going to be quite as good as everyone was hoping. I think it's inevitable that that's still generally going to be quite a high cost for a hotel going forwards.”

In a nutshell, while the UK hotel market grapples with a gamut of challenges, from financial to operational, the sector looks poised for sustained growth and industry experts remain cautiously optimistic about its near-term and long-term prospects.