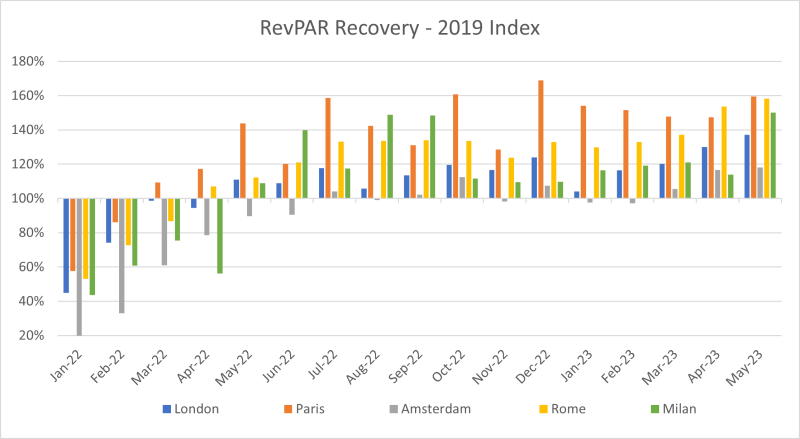

The hotel sector in London, Paris, Rome, Amsterdam, and Milan is showing a robust recovery over the past 24 months, data from CoStar has found.

According to CoStar Group, a real estate market data and analytics company, from a pricing standpoint, hotels in these cities are securing rates significantly ahead of 2019, with Paris leading the pack in regard to this metric due to the city having a higher share of hotels at the upper end of class spectrum, including a number of palace hotels which command very high room rates.

From a room demand perspective, London took the winning spot due to it being a bigger city and also having more inventory than the other cities.

Turning to Rome and Milan, CoStar noted that both cities are demonstrating comparable average daily rates (ADR) to the UK's capital.

Looking ahead, the data analytics company forecast increased interest in Paris due to the Rugby World Cup set to hold in September and October this year as well as the Olympics which the city will host in 2024.

Why it matters

The resilience of the hotel sector in these major European cities, as seen in their recovery from the pandemic, bodes well for the future of the industry. Higher ADRs continue to hold up for major tourist hotspots and the interplay between various factors like city infrastructure, tourist attractions, event hosting, and tax regulations continues to shape the landscape of the hospitality sector. The big question is can this continue if and when things start to worsen for consumers and businesses.

What they said

Cristina Balekjian, director of UK Hospitality Analytics at CoStar Group said: “Anecdotally, the trend may be for tourists going to other European cities as they get the tax-free shopping which is no longer offered in the UK. However, the room demand rates indicate that foreign tourists are not retreating from London altogether, especially if they are long-haul visitors. Typically visitors from the US, Middle East and China would do a European tour and are still likely to still come to London as part of their trip, even if they are spending less on shops or luxury goods.”