High-end travel has really had a remarkable run since the global financial crisis more than a decade ago. Wealthy tourists have increasingly looked for exclusive trips as a way to stand out from their peers but with many economists predicting tough times ahead can this enthusiasm continue?

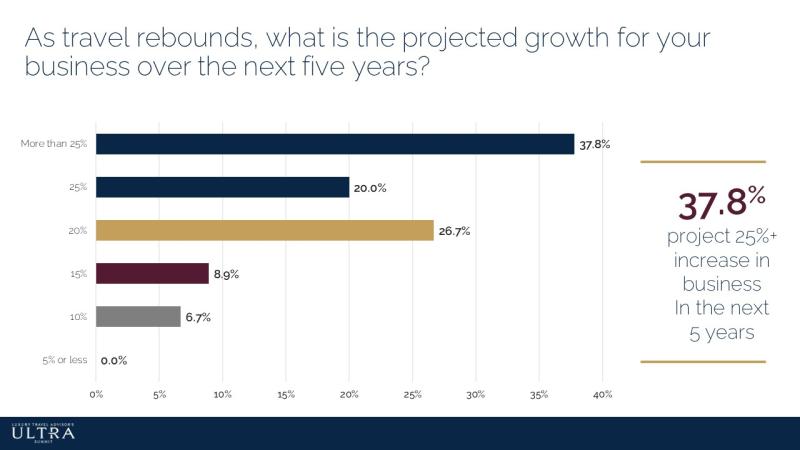

For luxury travel advisors, the answer is yes. According to a recent survey, 96% of those that took part on a recent survey think the sector will grow over the next 12 months. Remarkably 38% of respondents projected a 25%+ increase in business in the next five years.

This confidence that things are only going to get better seemingly flies in the face of what we are seeing across much of the world. In the US consumer spending rose only 0.1% in July after growing 1.0% in June. In the UK consumer confidence is at its lowest level since records began in 1974.

Recency bias or something else?

In psychology the concept of recency bias means favouring things that are happening now or a short time ago versus things in the past. Given that leisure travel in particular has enjoyed a spectacular return after Covid-19 lockdowns ended it is not surprising to see luxury travel advisors coming off a bumper summer expecting this to continue. It’s just human nature to expect what is happening now to keep going.

In uncertain times, however, one of the most instructive things to do is to look back at what happened in the past.

Earlier this year analysts at Morgan Stanley took a closer look at what might happen to high-end consumers.

“Dating back to the early 1990s, there has only been one prolonged period of Y/Y declines to average annual expenditures among the top 20% of earners in the US, which coincided with the 2008-09 GFC [Global Financial Crisis], when both financial and non-financial wealth for high-income earners was negatively impacted by the combination of declining stock prices and home price decline,” analysts said.

Since the analysis came out in June, things have improved somewhat in the US economy, which may mean that the luxury sector is able to prove more resilient.

Geographic split

What’s interesting about the current situation is the geographic split. Although there has been a general slowdown, the situation in the US is very different to that in Europe where its proximity to the Russia/Ukraine conflict and its reliance on gas from Vladimir Putin’s regime has put it in a much worse situation.

The above survey was carried out by the Luxury Travel Advisor’s ULTRA Summit, which is a sister brand to Hospitality Insights. All the respondents were based in the US, which may partly explain their confidence. Around 40 people responded to the survey questions.

Almost three quarters of respondent have an average customer age of between 51-75 and 44% have an average client spend of between $25-50,000. Big spending baby boomers is a good market to be in.

Europe was the most requested destination, which may reflect the strength of the dollar against the pound and euro.

“It depends on which market you’re looking at. I think in the US… they’re in great position, the dollar is really strong… and I think that plays a part depending on who your audience is,” Roger Allen, CEO of advisory firm RLA Global.