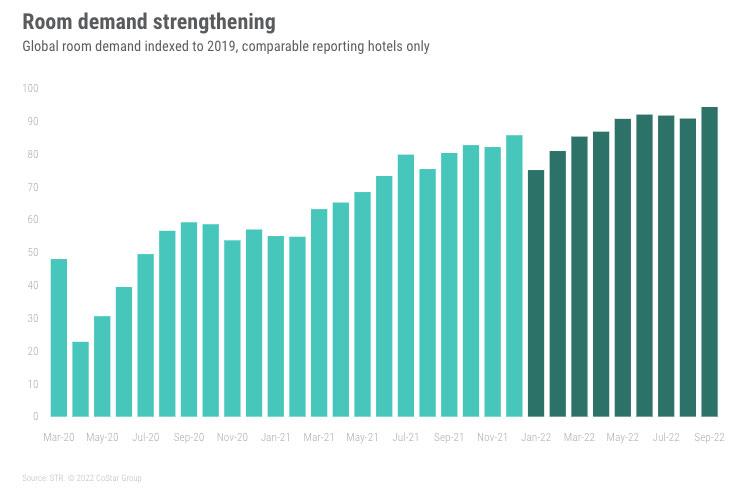

Global hotel demand continues on its recovery trajectory with new data from STR showing the industry had hit a pandemic-era high at the end of the third quarter of 2022.

Among comparable, reporting hotels — those properties reporting data for the 2019 and 2022 year-to-date periods — September demand was just 6% shy of pre-pandemic levels.

September was the fifth consecutive month with global demand recovery at a relatively stable point, at slightly more than 90% of pre-pandemic levels.

This means either that:

· The moderation in recovery pace over the past several months suggests there has likely been a reset in demand mix, as above-average leisure demand heads toward normal levels and corporate travel picks up steam.

· Or that this we’re never going to return to pre pandemic levels ever as again and this is as good as it is going to get.

While demand edges toward full recovery, average daily rate (ADR) has not just reached but surpassed pre-pandemic levels by a wide margin. While part of that growth has been driven by a global inflationary environment, real ADR, or ADR absent the impacts of inflation, has consistently remained at more than 90% of pre-pandemic levels.

The story is different across the world, however. Europe and the Americas are dealing with record-high inflation. The Middle East, in a strong position economically, looks to continue driving major event demand to counter high supply growth all while seeing some of its primary source markets affected by economic concerns. The Asia Pacific region only recently saw several major destinations (Japan, Thailand) reopen, and China, the region’s largest source market, remains restricted with zero-COVID policies.