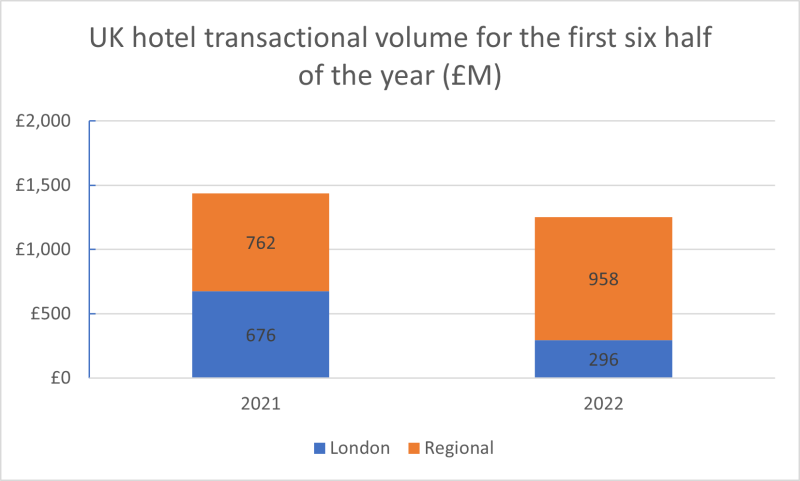

The pace of UK hotel transactions slowed down in the first half of 2022 as the market dealt with the fallout from the war in Ukraine and growing economic uncertainty, according to a new analysis by specialist hotel property adviser, Christie & Co

Regional UK transactions dominated representing almost three quarters of total volume.

Interestingly the proportion of distressed transactions has almost doubled compared to the same period in 2021, although it still remains at a relatively low level making up 14.9% of transactions.

While the dealmaking environment has started to fall off, operationally hotels are enjoying a boom thanks to the success of the COVID-19 vaccines and pent-up travel demand. Occupancy levels have recovered at a much quicker rate than anticipated since January and are nearing 2019 levels in most markets since May 2022.

There has been less discounting in the market with high ADRs helping to absorb some of the increasing cost pressures.

Notable transactions

| Date | Vendor | Purchaser | Deal |

|---|---|---|---|

| February 2022 | Alchemy Partners | Harris family and Kings Park Capital | The fast-growing Inn Collection group was sold by Alchemy Partners to a newly-formed company owned by the Harris family in conjunction with Kings Park Capital in a reported £300 million deal. |

| February 2022 | Chardon Hotels (Taylor family) | Atlas Hotels (London & Regional Properties) | L+R's Atlas Hotels acquired the Chardon Group of six hotels located across Scotland for an undisclosed sum. |

| May 2022 | Jessica and Peter Frankopan | Experimental Group | French hospitality firm Experimental Group boughtCowley Manor Hotel in the Cotswolds for an undisclosed sum. |

| June 2022 | McMillan Family |

Bespoke Hotels |

The 3-strong McMillan hotel group in Scotland was acquired by Bespoke Hotels for an undisclosed sum. |

Source: Christie & Co

What they said

Carine Bonnejean, managing director of hotels said: “Whilst we are now firmly past the covid crisis, the hotel industry and the wider real estate market are likely to experience further turbulent times in the months to come. The pace of the recovery was completely unexpected with performance ahead of 2019 already, a far cry from the 2 to 3 years originally anticipated; however, we may be entering another phase of the cycle by the end of 2022.”