Incentive travel — alongside its travel siblings meetings, conferences and events — took a hammering during the pandemic and were slower to return than leisure travel in its aftermath.

Things, however, are looking up especially with much of the world removing lockdown restrictions but that doesn’t mean returning consumer and business confidence will flow into growth for incentive travel, at least according to a new survey by Hospitality Insights parent company Questex and the Incentive Research Foundation

The good news: nearly two-thirds of the industry indicate incentive travel is trending up for 2022 and beyond, with 13% saying incentive travel will increase by 50% over the next 18 months.

The bad news: the industry appears very concerned with how hotels are going to maintain service levels.

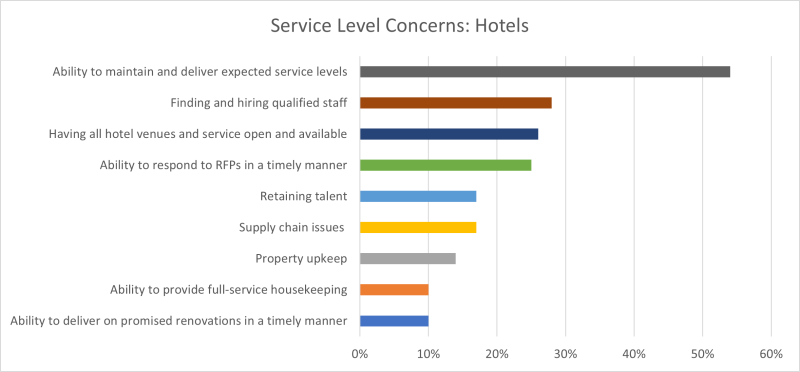

Service levels are of great concern when thinking about the next 18 months. 54% of incentive planners cited the ability to maintain and deliver expected service levels as their primary concern.

Finding and hiring qualified staff was cited by 28%; having all hotel venues and service open and available was cited by 26%.

“The COVID, supply chain, or staffing shortage excuses is not something we want to hear today if we are paying the same cost or higher as pre-COVID,” one incentive planner noted

Labour drain

While the hotel industry may be struggling to replace the hundreds of thousands of workers that have left the industry since the pandemic, squaring that with reduced levels of service at the same or higher prices is difficult for both consumers and other travel sectors.

Only 49% of properties report they have achieved pre-COVID staffing levels. Another 38% are working to staff up over the next 6 months.

Not everyone shares this outlook, however. Speaking on a recent earnings call Marriott chief financial officer Lenny Oberg said the situation was improving.

“[O]ne of the things that I think is interesting is to look at the positions that we’re trying to fill if, for example, normal staffing levels were that we were trying to fill the final 95% to 100% of the positions we needed at the hotel level,” she said

“Right now, we’re at 93%. So it’s definitely improved. It is not back to where we were in ‘19 in terms of the labour shortage, but we’re definitely seeing steady improvement, and the wage increases have slowed.”

One of the major concerns for incentive planners is the speed with which hotels respond to RFPs. Of those surveyed 84% said they responded within a few days – a timeframe that meets the expectation of the industry.

The study was conducted from late April through June 2022. A total of 710 respondents completed the survey, represented four stakeholder groups, incentive planners / third party agency, hoteliers, tourism board/convention & visitors bureaus, and destination management companies.

Differing priorities

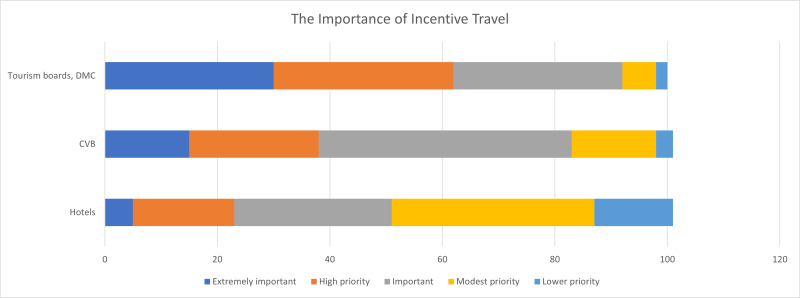

For those with a biggest stake in incentive travel e.g. convention bureaus or tourism boards, the sector is much more of a priority than for, say, the hotel industry. Even so, there will be hotels in certain markets that value it much more importantly.

And while it might not be the most important area, it is one CEOs value.

Speaking about the US market in particular on a recent earnings call, IHG CEO Keith Barr outlined his optimism.

"There remains further potential for business travel recovery, especially within the meetings, incentives, conferences and exhibitions segment. And as with leisure demand, we see no indicators that the recovery trajectory is abating," he said.